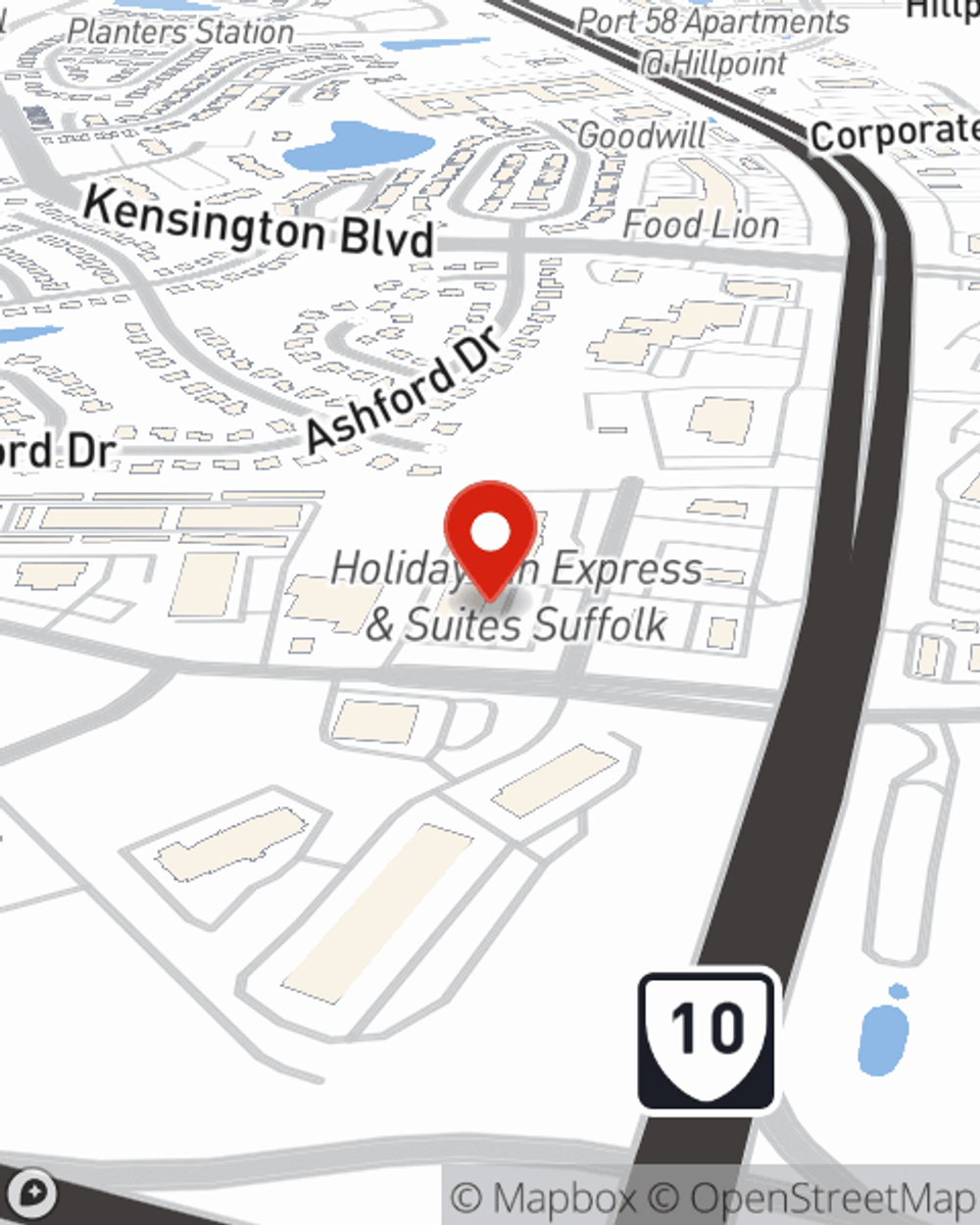

Life Insurance in and around Suffolk

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

- SUFFOLK

- CHESAPEAKE

- NORFOLK

- VIRGINIA BEACH

- NEWPORT NEWS

- PORTSMOUTH

- RICHMOND

- SMITHFIELD

- NORTH CAROLINA

- MARYLAND

Protect Those You Love Most

Taking care of those you love is a big responsibility. You go to work to provide for them advise them on important decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Love Well With Life Insurance

You’ll get that and more with State Farm life insurance. State Farm has excellent protection plans to keep your loved ones safe with a policy that’s personalized to accommodate your specific needs. Fortunately you won’t have to figure that out by yourself. With strong values and fantastic customer service, State Farm Agent Warren Alexander walks you through every step to set you up with a plan that secures your loved ones and everything you’ve planned for them.

Simply get in touch with State Farm agent Warren Alexander's office today to check out how a company that processes nearly forty thousand claims each day can help protect your loved ones.

Have More Questions About Life Insurance?

Call Warren at (757) 484-1521 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Warren Alexander

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.